Chase’s $800 Sapphire Reserve: The math is messy, but the strategy is brilliant

Chase and Amex are transforming credit cards into lifestyle subscriptions, designed to redirect your spending. (And for the first time, I’m reconsidering my membership.)

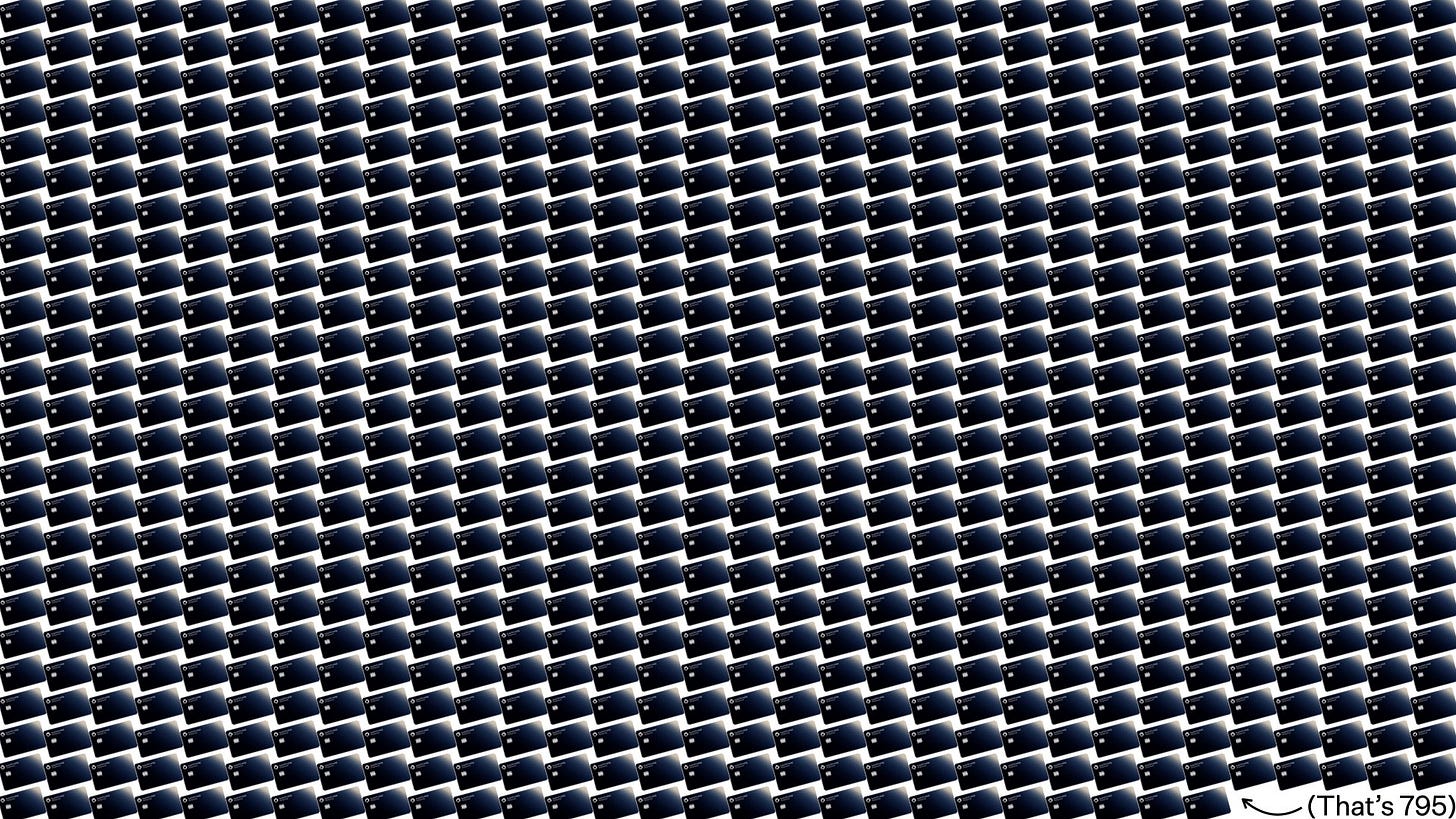

Is a credit card with an $800 annual fee worth it? For most people, almost certainly not. But that’s how much Chase is now charging for its flagship Sapphire Reserve Visa card: $795 to be exact — a classic sticker-shock concealer — up $245 from its previous annual fee of $550.

The higher-fee card comes with what Chase describes as “more than $2,700 in annual value.” That’s mostly in the form of rebates for purchases at select merchants, including luxury hotel partners, Lyft, Peloton, DoorDash, and StubHub.

It’s a great example of how card issuers like Chase and American Express are trying to transform their highest spenders from mere points collectors into “members” of a more elaborate lifestyle subscription, increasingly based around a treasure hunt of “value” they unlock through — of course — more spending.

Amex has been driving this movement with its Platinum card for the past several years — now sporting a $900 annual fee (sorry! $895) — including access to a growing network of branded airport lounges, priority restaurant reservations, and its own version of these coupon booklets designed for upwardly mobile Millennials.

If I sound skeptical about the value proposition here, let’s walk through how a few of these rebates work.

Chase, for instance, lists $300 in DoorDash credits as one of the main features of the new Sapphire Reserve.

But to use the full $300 in credits, you have to really do some work, making 36 transactions over the course of a year.