How Americans really think about seed oils, Poppi & Olipop, and MAHA

In-depth research from our latest Consumer Trends report.

Hello hello! It’s Dan Frommer, back with The New Consumer. How’s Q1 looking on your end?

The big news this week is that PepsiCo announced it would spend $1.65 billion to acquire Poppi, the low-sugar, prebiotic soda startup that launched in 2018.

Excellent timing! I just published a new Consumer Trends research report with Coefficient Capital that features, among other topics, a section about the modern soda category, including Poppi and its rival/peer Olipop.

For years, Pepsi made its appeal to “a new generation” a big part of its marketing. (The GeneratioNext™ campaign was so ’90s it hurt.) Now it’s betting that the next generations will be increasingly more interested in drinking Poppi-branded soda than Pepsi.

I think that’s correct. Or at least, for PepsiCo, it’s worth spending the equivalent of 1% of its market cap to find out. I also think Poppi feels more Pepsi-coded than Olipop does, so brand-wise, it feels like a good combo. That is — assuming the Trump admin doesn’t block the deal, Pepsi doesn’t screw it up, etc.

Today: In-depth highlights from our latest Consumer Trends research on healthy soda, seed oils, and the MAHA movement. But first, What’s Working, in partnership with The Malin.

The Long Game — How Made In is trying to build an enduring cookware business around quality, not flashiness.

“In 2020 to 2022 you saw a lot of these … very colorful [cookware] brands pop up, and just absolutely duped the market,” Made In co-founder Chip Malt said at our What’s Working event at The Malin in East Austin.

“When you get into the science of it … what they’re doing is they’re putting a really sh*tty pan underneath beautiful color, and making it look beautiful on Instagram, and then screwing the customer. They’re charging insane amounts for the actual quality of that cookware. It’s encapsulated aluminum. It doesn’t heat well, it degrades really quickly.”

“It’s really hard as a brand,” Malt said, to “not follow that trend. When you hear … all the investors talk and chirp in your ear, ‘x brand is doing this. Two years in, they’re growing 100%.’ …To not follow that trend and hope that the consumer comes back to quality at the end of the day.”

“The coolest thing for us as a brand is watching the people who those brands got as their Instagram influencers … come to us and say, ‘I can’t honestly represent that brand anymore. Can I work with you all?’ And that’s happening in droves right now.”

For Made In, “It was just a huge focus on product quality. It was … resisting the urge to follow the trend, and it’s paying off.”

What’s Working is a partnership with The Malin, a hospitality-led workspace with locations in New York City, Nashville, and now Austin. Stay tuned for more highlights and takeaways from our event, or enjoy our whole conversation on YouTube.

Btw, if you’re looking for a workspace designed to inspire, The Malin recently announced its next NYC location is coming this year to the Flatiron, a short walk from its beautiful new NoMad space. Get updates here. I’ll see you there.

We asked 3,294 people to rate these four sodas

While putting together our new Consumer Trends Survey — where we poll more than 3,000 US consumers a few times per year, via Toluna — we were curious about a few things: Do people generally consider diet soda healthier than regular soda? Which tastes better? And how do the top modern soda brands, Poppi and Olipop, compare?

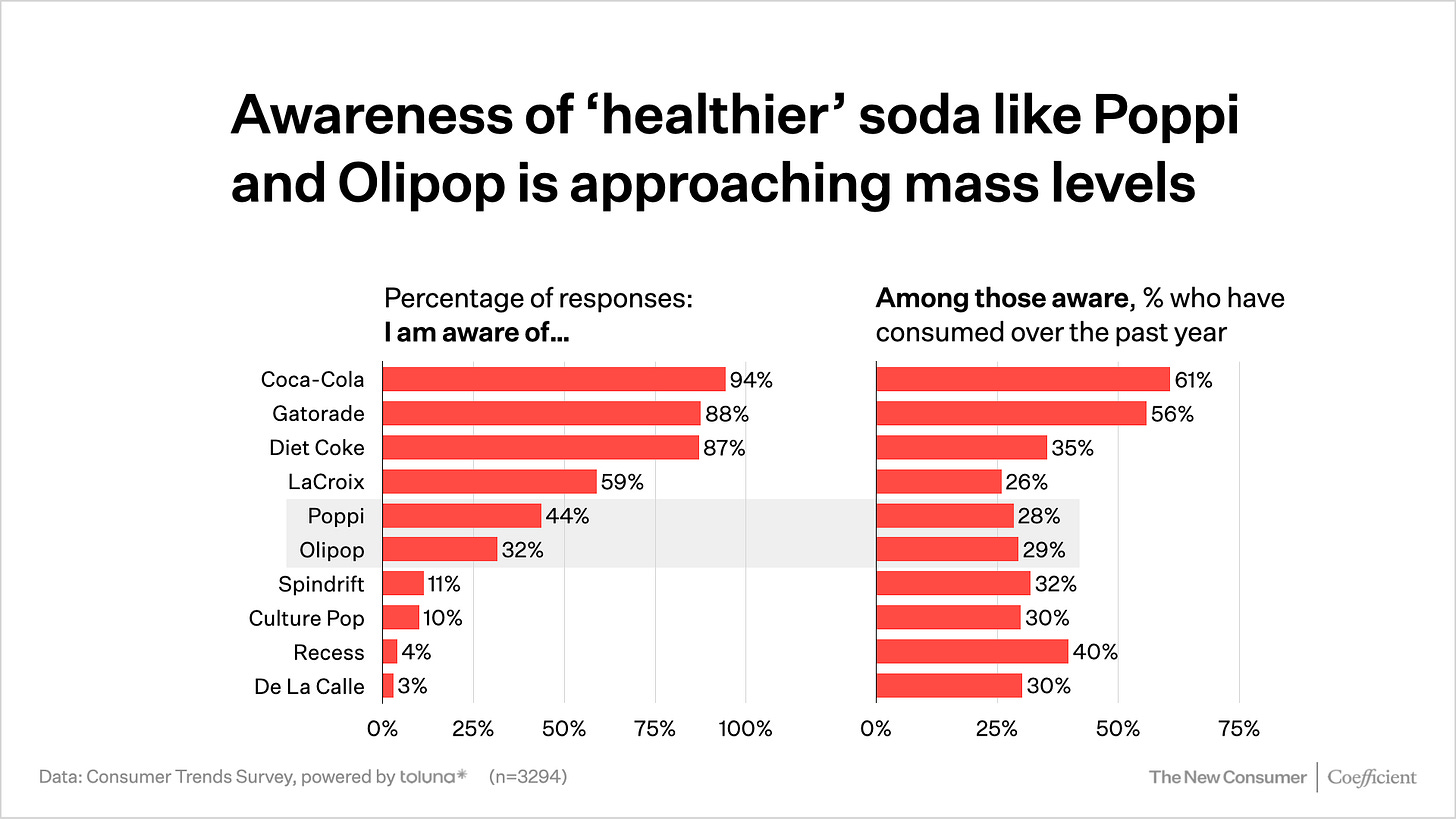

Some context first: When presented with names and logos, almost everyone — 94% of US consumers in our panel — says they’re aware of Coca-Cola.

What about the challengers? Many in the beverage industry consider Olipop the next-gen soda leader, or at least the serious pioneer. But among US consumers, 44% say they’re aware of Poppi, while 32% say they’re aware of Olipop (up from 11% in our November 2023 survey).

(We conducted our survey in mid-to-late February, shortly after Poppi aired a Super Bowl commercial for the second year in a row, and got into a silly controversy around sending vending machines to influencers.)

For both Poppi and Olipop, awareness is higher among women than men, and age-wise, awareness is pretty solid from Gen. Z past the Gen. X generation even into the Boomers. These aren’t just Gen. Z brands.

Which do consumers prefer?