How to build a better subscription business

Oats Overnight gets 90% of its DTC customers to subscribe immediately. Founder Brian Tate shares its strategy.

For many consumer brands, getting people to become subscribers via direct-to-consumer e-commerce is as good as it gets: Higher margin, higher lifetime value, and an engine for continuous growth.

Few food brands, however, have been able to build the sort of subscription DTC business that Oats Overnight has.

The company, which sells overnight oats kits in flavors like Space Brownie, Glazed Blueberry Donut, and Caramel Cold Brew, is into the nine figures in revenue, and has projected 80% growth this year.

Around 90% of its DTC customers subscribe on their first order, founder and CEO Brian Tate tells me, and 94% of its e-commerce revenue is subscription-driven.

How? More on that after a note from our sponsor: Join me in Chicago this month at The WSJ Global Food Forum, where I’ll be speaking along with the CEOs of Siete Foods, Albertsons, and Red Lobster. It’s coming up soon — June 16 and 17 — so please request an invitation today (and use my code NEWCONSUMER20 at checkout to save 20% on your pass). I hope to see you there!

Presented by The WSJ Global Food Forum

Join The Wall Street Journal’s Global Food Forum, June 16–17, 2025, at the Four Seasons Hotel Chicago.

This premier event gathers top executives, investors, policymakers, and innovators across the food and agriculture sectors for a full day of candid interviews and timely conversations.

Explore key topics including dining trends, climate innovation, farm policy, inflation, and investment in breakthrough technologies and products. Connect with influential leaders shaping the future of food — and leave with the insights you need to stay ahead.

As a subscriber of The New Consumer, use code NEWCONSUMER20 at checkout to save 20% off your pass.

Oats Overnight has even been able to improve its direct subscription business as it has expanded onto Amazon and into retail, including Costco, Target, and Whole Foods.

It also uses its subscriber base as part of its R&D machine, by continuously collecting feedback on new flavors in development — and to make tweaks to existing flavors — to maximize craveability and retention. It’s even incubating a new side business, a high-protein instant coffee mix, among its subscribers.

For more details, I recently spoke with Tate. What follows is a lightly edited version of our conversation. You can listen to the full conversation above.

Dan Frommer: Thank you so much for your time, Brian. To start off: What is Oats Overnight? What’s the product? What size and stage is the business now? And then perhaps a little bit about your unconventional founding background, too.

Brian Tate: Thank you for having me. Oats Overnight is a high-protein oatmeal shake that we launched in 2016 — we’re coming up on nine years. We have 60 different flavors, 20 grams of protein. You make it at night and it’s ready when you wake up. Our consumers enjoy this out of a shaker cup — so, basically, a spoon-free, high-protein oatmeal.

We are vertically integrated, so we control all of our manufacturing and fulfillment. Also, our quality and supply chain, procurement, and R&D is all in-house.

My background is a bit unique. I started out a long time ago playing Magic: The Gathering cards on the pro tour — I loved gaming as a kid — and then got into poker. I played professional poker for about 12 years. That journey started online for about six, and then I ended up moving to Vegas, LA, and playing live for the last six years of my career. Basically high-stakes, mixed cash games — a lot of different variants of poker.

Lots of interesting overlap with how that translates to business and decision-making and ultimately entrepreneurship.

I was going to say, high-stakes cash game sounds very much like CPG.

Yeah. One big pot.

How did you get to this product, and specifically the way that it’s presented and formatted?

Back around 2014 and 2015, I was making a homemade version — the classic mason jar and spoon recipe. Loved this. It was easy in the morning.

But the mason jar didn’t travel all that well. And so I opted for a shaker cup, added more milk and more protein to get it to more of a spoon-free, shakeable consistency, and also to meet my macros. And was basically making a version of this for about a year.

The measuring and preparing definitely got tedious, especially with travel. I’d run out of different ingredients, and ultimately looked for a prepackaged version, expecting to find it. But, of course, was surprised that it didn’t exist at the time. In my little circles in LA, overnight oats were a bit more popular than mainstream across the country. And so we thought to bring this to market.

We launched in 2016, but it was about a year of prep — building the formulas and figuring out packaging and website and the facility — before launching.

And were you making it yourself from the very beginning? Or did you have a co-packer?

Yeah, from the very beginning, made it myself — and so, didn’t realize how challenging this would be to scale up, given the unique ingredients and the ratios of ingredients. Co-packers weren’t really suited to do it in the way that we did. We found a small, 2,000-square-foot facility in Tempe, Arizona, and set up shop, registered with the FDA, hired an advisor, and just got to work.

We launched online in August 2016 and have been building ever since.

For someone who hasn’t experienced this, what shows up in the mail from Oats Overnight?

We sell this via 16-, 24-, or 32-packs. You get to pick a bundle of flavors: We have about 60 flavors available; 35 to 40 of them are available on the main site for new customers, and the rest are exclusively available to our subscribers. People order an average of 12 flavors per box; all of our shipments are custom.

You get a free shaker cup on your first order. If you choose to subscribe, you also get a discount on that first order. And every month, you’ll get a pre-release pack of a flavor that we’re working on in development.

Is the idea that most people eat this every single day? Is this a ritual? Or is this something that you think people are having a couple times a week?

It, of course, ranges across our customers, but most consume it daily.

What we found is that breakfast is pretty boring. People like routine, because it’s usually the most challenged part of the morning. If you wake up a little late, breakfast is the first thing to get sacrificed. Maybe you stop by a drive-thru to make up for it, maybe not.

With the prep at night, you just mix an Oats Overnight pack with a cup of almondmilk or regular milk — whatever milk works — into the shaker cup, just shake, and refrigerate.

And in the morning it’s basically a zero-minute breakfast you can grab and go. Eat it on the way to work, or eat it at your desk, in a matter of minutes. Super convenient morning, just with a little bit of nighttime prep. And so our customers usually stick to this four to five times a week.

What proportion of your customers now are subscribers?

Ninety percent of our acquisition orders are subscription, and about 94% of all of our e-commerce revenue is subscription-driven. So we’re very heavy subscription.

We really encourage the subscription because the benefits usually come with longer-term use. Again, people love to stick with this and really simplify their mornings. But also we really enjoy building products with customers, and so subscribing allows you to be engaged in the product-development process at Oats Overnight.

Did you launch with subscription as an option, or is that something you figured out later?

We figured it out later.

We actually launched with a starter pack, which is just a three-pack plus bottle. And over the last eight years we’ve been progressively getting into higher and higher pack sizes, especially as we opened up retail as another channel.

We feel that retail — that ability to buy a single bottle of our product, in a slightly different format, but similar experience — behaves as a really good sampling channel that complements our direct-to-consumer.

How did you figure out that subscription was going to be the key to unlocking success with direct-to-consumer?

Customer acquisition cost (CAC) is expensive. When you’re thinking about profitability, you start to look at payback periods by cohort and retention rates by cohort, and how quickly it takes that revenue and contribution profit to pay back CAC as a matter of months.

You learn really quickly that CAC is doable when you have good retention, and oftentimes really sinking money if you don’t have good retention.

Looking at those cohorts, you learn really quickly that subscription is pretty critical to any high-frequency product. And so we’ve continued to push customers to choose that subscription option — really incentivize them to choose the subscription option more and more often over time. And that’s come with really big increases in lifetime value and more profitability.

How do you do that? How do you get them to become subscribers right off the bat, but then also remain subscribers?

Off the bat, I’ll say the first-time subscription incentive.

We know that customers generally want to try something before they commit. We have a very generous cancellation policy, and so making it very clear they can cancel — we send a reminder email — as well as a first-time subscription discount of 25% if they choose to subscribe. That usually tips the incentive toward customers feeling comfortable subscribing on first order.

From that point, it’s really a bet on product. We’re betting on the fact that customers will subscribe, and maybe set a calendar reminder — “Remind me to cancel this before it renews” — but we hope that the product is so good that when that calendar reminder comes, they say, “Actually, you know, we’re enjoying this. Maybe we won’t cancel. We’ll take another month.”

And so we look at retention not just as a sales and marketing challenge, but also a food science, R&D challenge. We have an in-house team of R&D food scientists that work on this product all day, every day, and use data to do so.

We’re big believers that in CPG, product is the most important thing. This seems simple, but I think it’s overlooked by a lot of brands — especially startup brands, who effectively agree on a formula, then launch it into market, and it becomes a sales and marketing challenge on the retention side.

We look at product as very iterative, which I think is also uncommon. We’ve built a structure to make tweaks to our product, and then look at how those tweaks impact retention. So, say, increasing or decreasing sugar or sodium, sweeteners, and how that will impact customer experience and ultimately repurchase rates.

We have a lot of custom data tools that we’ve built to track those different behaviors, and also track feedback in response to formula changes and when they hit the market. It’s a pretty heavy process. We have 13 full-time food scientists that are looking at this data, reviewing it daily, and making tweaks to products in market with the goal of increasing customer lifetime value (LTV), ultimately, and increasing satisfaction.

I’m really proud to say that our LTV over the last five years has grown at well over a 20% CAGR, which I think is a really good signal that this continuous product improvement is working well.

And then also including customers in the process, pre-launch, sharing products in development with subscribers has been very beneficial to us — de-risking that roadmap, but also bringing customers into the experience and driving a lot of connectivity and engagement with the brand.

Is there an example of a formula tweak that you remember that made a meaningful change in any of those characteristics?

One of the recent ones that we just built a little internal case study on was our Maple Pancakes flavor.

We’ve been playing with sugar counts and trying to understand craveability trade-offs with sugar and sodium levels.

In what we call our “flavor command center,” this was the 18th highest retaining flavor. And after the tweaks went to market, we had some really good early signals. Within two months, this was the 12th highest retaining flavor. So a pretty meaningful change.

It’s also really exciting to be able to not just get the binary result — was this good or bad? — but also the magnitude of impact, which I think is really unique. And so we do this, again, at scale. There’s dozens of iterations happening every month with our product roadmap.

You mentioned macros at the beginning. Is your customer counting macros? Are they counting sugars? Is is lower sugar always the move that they want from you? Or is it a little more complex than that?

It’s a little more complex. All of that matters.

What we learned is that taste is really one, two, and three with customers. You really have to hit the taste piece.

Customers will consciously choose, maybe, a lower-sugar product that meets their expectation of nutrition, but they won’t subconsciously crave it. And so they’re going to go right back to what they were eating before. They’re not going to stick with you.

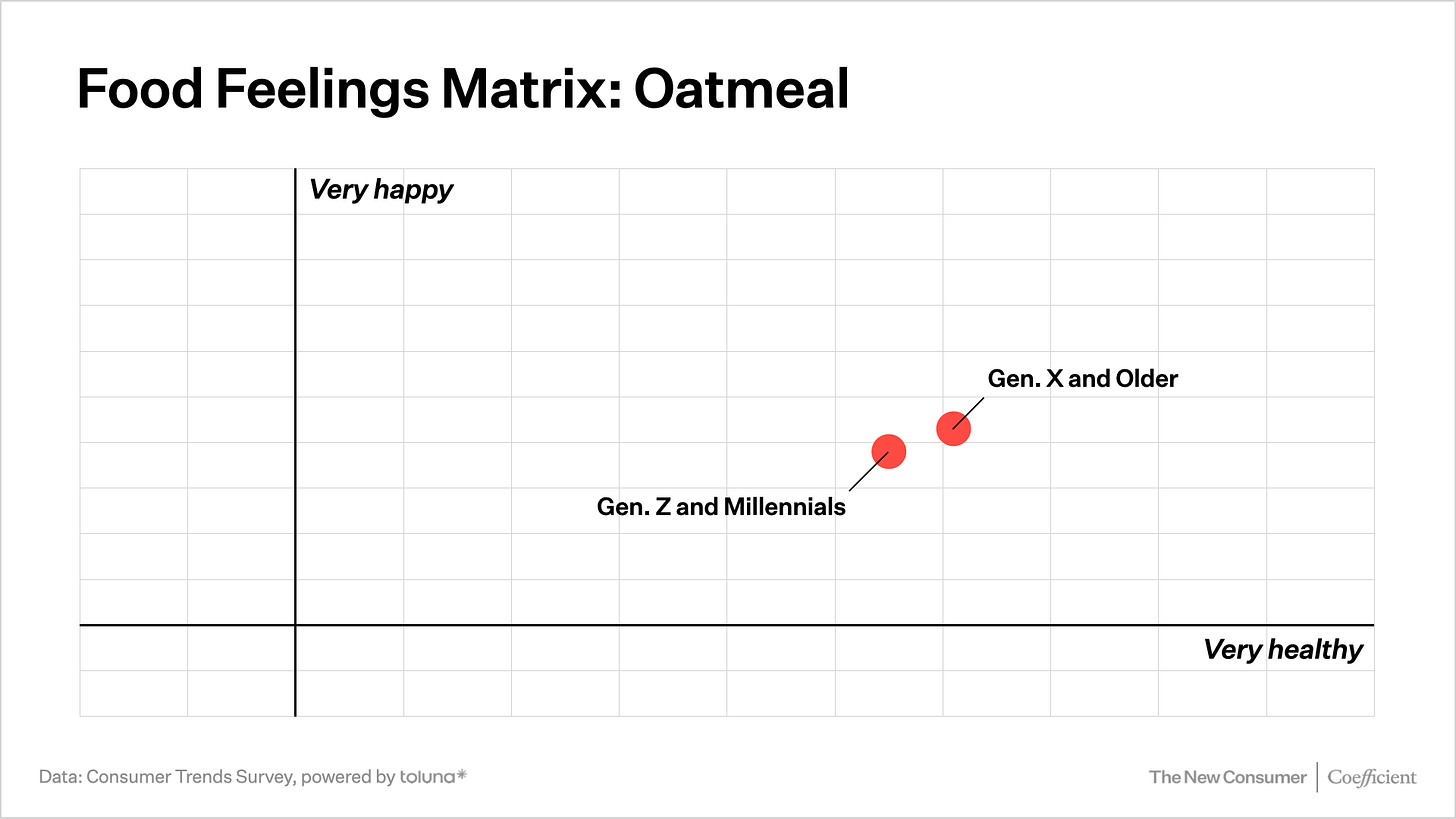

We’ve seen this over the last four or five years, where there’s been a lot of focus on no-sugar, low-sugar, and then also natural, and all these different elements that make up what we define as a healthy product.

But the reality is that taste is number one.

So if you are trying to go all-natural, but also no sugar, and sweetened with natural sugar substitutes like monkfruit and stevia, that is a very high-friction road, and I believe those roads will not work. You see this in market with a lot of the zero-sugar brands going artificial, like sucralose, ace k — that road drives a better taste profile that customers will actually crave and retain on.

Of course, everyone has different palates. But that profile of zero-sugar and artificial is one that I think works. If you go natural, you have to do some sugar.

What we focus on is natural, some responsible sugar — under 10 grams. And we’re constantly working on what that optimal sugar count is for each flavor profile. Of course, looking to minimize it as much as possible, but also drive a craveable experience for the customer that they’ll come back to.

Looking at your site, I see your array of flavors is — you weren’t kidding. You have a lot of different flavors here. And including some that, to someone who’s just looking at a web page… The difference between Chocolate Satin Pie overnight oats and Chocolate Cake, or Space Brownie… How different are these? Is this variety for variety’s sake? Or do each of these actually have enough differences that people become a customer for those?

We’re probably on flavor 62 or 63 right now, so there’s going to be some shades of overlap with these profiles.

Customers love chocolate flavors, and each of these chocolate flavors have slight variations in the profile and how chocolate is represented. And so I’d say that there’s some incrementality there. (With, of course, diminishing returns as you get out there.) A lot of this is building the business with customers — building flavors with customers is really core to the brand. And so we like a lot of variety.

We call it “extreme flavor variety” as a tenet internally here. But we do feel it’s accretive, in the ability to mix and match, and share with families, and ultimately build that unique experience.

Blueberry cobbler has 5,925 star ratings. And several of these flavors have three, four thousand of them. Do those actually correlate to anything?

We track product feedback in a lot of different ways. The reviews that we put front-of-site are the classic structure where customers can leave a star rating. I believe we work with Junip — a little shout-out there.

We also have a review system behind the portal experience, where subscribers can rate their flavors and that gets fixed to their shopping experience, so they can remember what flavors they tried.

They can also leave notes on a per-flavor basis — this was a big request from customers. They were sharing in our private VIP Facebook group that they were tracking via Google Sheets and notepads and losing track of which ones their families tried and liked. And so we built that tool for them.

We also monitor those changes over time. So when we launch a new formula iteration, we can see the changes to that star rating and changes to any notes, pre- and post- that change.

This huge number of flavors… Is that something you’ve learned is just absolutely true to build retention? Or are there also many great customers who just get the same one to three flavors every single time?

We do see an average of 12 flavors per box.

We think this is pretty special, pretty powerful, in that, again, we’re competing in a very boring category. We always say breakfast is boring, so we want to spice it up and add that variety.

I’d say that our data shows that customers consolidate to the flavors that they like over time. It’ll trend toward five to six flavors.

But we also see that new flavors coming out drives a lot of curiosity and a lot more variety seeking.

Fun little fact here: Our highest performing flavor is only 6% of our total sales. And so there is a ton of variety in terms of consumption. That’s rare for most food companies that ultimately see consolidation around a few of their core SKUs.

Are there any early indicators of someone about to churn? And is there anything special you do to try to retain them if you see that?

There’s not anything special that we do there.

We do play a long game. If somebody is interested in getting a refund, or they don’t like flavors, we have a “love it or swap it” guarantee to really encourage that variety seeking.

And, ultimately, if they just want a refund, we give it to them. We’re firm believers in playing a long game. We just hope that if someone churns, in six months, they see it at Costco at a price that’s worth re-engaging. Now that we’re omnichannel, we do think a lot about how those channels behave in that customer’s experience over a five-plus-year horizon.

Now that you are very much in the business of trying to attract basically almost only subscribers, is there a different type of customer that you’re targeting with your advertising or messaging? Are you spending more, are you spending differently?

We don’t necessarily target a different customer. Our targeting is extremely broad, in that our demographics across our customer base are quite broad. Which can be good and bad: Good because it’s a huge addressable market; bad in that marketing messaging can be challenging when you’re serving a wide range of people.

But ultimately, we don’t segment with that in mind. We do still offer that one-time purchase option, and we do feel that as we’ve changed our pack sizes, we’ve shifted into a slightly different consumer.

With the omnichannel nature of this — now over 10,000 doors to try this at a $3 price point — we look at direct-to-consumer more as a subscription engine for customers that prefer to interact with the brand that way. And if you’re more of a one-time buyer, you want to sample, or you’re a little hesitant to jump in, you can now find it at Costco, Whole Foods, Walmart, Target — pretty much any other retailer that we’re served in, for a very low price point.

Which is still where most people buy most groceries. So I’m curious: I assume you were already on your way to this path of building a subscriber-based direct-to-consumer business when you started entering these large retailers. Were you worried about losing subscribers to retail? How did you think about the product and packaging for retail? Walk us through some of that thinking.

We have a pouch with a shaker cup — that was the product we launched with direct-to-consumer. It’s very optimized for that subscription experience and that direct-to-consumer experience, especially from a shipping perspective, to minimize that cost.

The problem translating that to retail is that the pouch requires that shaker cup for a good experience. We know that not everybody reads instructions. And so we felt that putting that pouch on shelf without the ability to merchandise the shaker cup could lead to some friction and some challenge on the consumer side.

So we chose to reformat the product before launching into retail.

The product we have in grocery now is a bit of an adaptation from our pouch and shaker: It’s basically a small, single-use bottle with a fill line. We’ve made a powdered oat milk and mixed that in. So now the consumer just has to fill water to that line, shake, and refrigerate.

They have the same experience as the pouch and shaker, just out of that single-use bottle. We know that some customers prefer this; some customers prefer the direct-to-consumer version. But this fits really nicely on shelf and sits really well in that hot cereal set that we play in. It makes it much more clear — the differentiation of the product, without the spoon.

We’re big believers in building for each channel, trying to cast a wider net, and building a unique experience for each channel.

We’re not really big into manipulating the customer experience or trying to incentivize people to discover in-store and then repurchase online. We’d much rather just create a low-friction experience for customers to purchase wherever they feel best.

I think a lot of other companies mistake this — they’ll try to chase a few extra points of margin by pulling them from Amazon to direct-to-consumer. But ultimately, we believe if someone’s grocery shopping on Amazon, we don’t really want them to come out of their comfort zone and buy on our site. We’d rather be on their grocery list on Amazon, and make it low-friction for them.

We feel this method has helped us continue to grow in each channel without seeing the cannibalization that a lot of brands see as they go from direct-to-consumer to omnichannel. We’re still 70% direct-to-consumer this year, which is pretty exciting. We continue to see great growth in that channel and are very optimistic.

I did notice on the package — there were three flavors available at my local Sprouts, and I see you have your Instagram handle on the bottle, but not really anything like, “Hey, there’s 74 more flavors on our website,” or anything like that. No QR code, no discount, or anything like that.

I believe we have the website there, but we really try to keep that shopping experience pure for each consumer. Ideally, they’re educated on the different formats, but we don’t want to push them to buy in a channel that’s outside of their comfort zone.

If we’re on the grocery list at Target, that’s good for us. If they see an ad and want to switch, that works too.

Discovery at retail — is it a meaningful subscriber driver online, or not really?

Oh, yes, absolutely. We measure this in a few different ways, but the most simple, and oftentimes the most accurate, is just the post-purchase survey — where they first heard about us.

Retail, Costco, these have clicked up meaningfully over the last couple years as we’ve scaled. And we see that oftentimes retention and overall LTV is higher among the segments that discovered us in retail or club.

You have this great subscriber base. How do you think about selling them other stuff? Either new products or extensions to your line, or even sub-brands, or new brands, or anything like that?

This is something we’re thinking about a lot lately.

We’ve really built the brand around that consumer experience of building products with us. We like to say we’re more “people making products” than a brand. That’s shown in our organic socials and the way we interact with customers and bring them into the process. We do think there’s a big opportunity to add more products to the mix.

We’ve added what we call a PID, or product in development, of powdered instant coffee — high-protein instant coffee — into those boxes. And we’ve been incubating that with our subscribers, starting with that free sample in subscriber boxes, all the way to now having a portal experience that’s exclusive to subscribers, with about 12 flavors that they can bundle.

We’re getting feedback on that product line, monitoring retention really closely, and continuing to engage our customers to decide flavors.

Also, if you subscribe to that product in the portal, you get a new flavor in development for that product line every single month. And so they’re helping us build out that flavor roadmap.

Ultimately, once this product has the retention that rivals Oats Overnight, we’re going to bring this more forward-facing and start driving a little more growth outside of our current base.

But we’re not there yet. We’re sort of testing and learning on this process. We think it’s an exciting one, and there’s a real opportunity to build more of a platform that’s focused around community and R&D.

Zooming out and maybe generalizing a bit, are there any traits of Oats Overnight — but also, more generally, traits of products — that you think are ideal for these sorts of really sticky subscription businesses?

Products that are high frequency.

For us, it’s very routine. We like oatmeal for that. It’s a convenient morning breakfast that checks all those consumer needs. So we think this fits really well for a subscription.

This might be a little less applicable for snacks or something that is a little more impulsive.

Beyond format, thinking about craveability. If you consume this product 10 days in a row, are you craving it on day 11? That’s a really interesting challenge to think about when formulating.

What we’ve learned is that food scientists oftentimes formulate to a standard. If the product is chocolate cake, they might actually have a slice of chocolate cake, and they want it to taste like that, and they’ll look to get it as close as possible.

But oftentimes, what tastes the best in a single-serve sample is not what is most craveable over the long run. Oftentimes, these things are similar. Sometimes, they vary slightly or vary greatly.

And so we really think about that lifetime value and high-frequency consumption when we’re formulating. That comes into how we think about sodium levels and how we think about the balance between real sugars and sugar alternatives like monkfruit.

This can apply to a lot of different categories, but it’s something that we found to be very beneficial.

Assuming someone has a product that is potentially a good subscription product, are there any low-hanging fruit — in terms of value prop, offer, website design, etc. — that you would always say are the first things that brands should do to increase subscription adoption?

I think one common misconception, especially in a time of rising customer acquisition costs, is when brands look to create more of a sample offering. The idea being: Let’s get this into as many hands as possible for as cheap as possible.

But when you look back to that payback-period analysis, how valuable are those cohorts that try the $10 version versus the ones that maybe subscribe for $60? I think you’ll find that the larger-entry-point AOVs are much more valuable on any long-term basis. And so we’ve really pulled back that sampling effort.

I still see a lot of brands leaning into that, and you can definitely tell that’s not a very healthy strategy long-term, although it seems pretty intuitive at a glance.

Lifting up AOVs, offering incentives, really de-risking that subscription decision with clear messaging that you’re emailing and offering cancellation — we’re very generous there.

I think most subscription businesses find when they email customers about their subscription for any reason, it increases cancellation.

For us, consistently reminding them that there’s a new flavor in their box this month; this is the flavor we’re working on; reminding them to customize their order — we’re pushing a lot of portal activity, which usually correlates with higher cancellations. You’re just putting them in the portal with a clear ability to cancel.

It’s a little bit conflicting there. But we’ve just dove in and we want all of our customers in the portal as much as possible, because we know that engagement with their box, customizing their flavors every month, and seeing what’s next in development — that all drives higher retention, even though the nature of logging in or having access to it can often increase churn.

We’re an active subscription, where customers are very actively engaged month-to-month, versus passive, set it and forget it, subscribe and save.

One reader asks: What are the pros and cons you found for vertical integration?

This is a big one. There’s a lot of pros and a lot of cons.

It’s a separate business in and of itself. We have a very large headcount. A lot of this is the actual facility itself and all the different departments that service that part of the business.

The pros are massive: The ability to differentiate your product by owning the manufacturing is huge. We often find the ability to tweak tooling to create a differentiated experience.

This is a moat. It’s harder to follow us, because we’re able to continue to iterate in ways that competitors that pack through a co-manufacturer wouldn’t be able to follow.

There’s a huge cost benefit. Another big pro: We’re not paying any third parties’ margin. This is all at cost, and we are quite good at this now. There was a bit of a learning curve, of course, the first four or five years. But we fully are there, and tons of efficiency in the process. Very high quality.

The third thing I’ll say — timely — is the tariffs. We have direct relationships with all of our suppliers. When you’re working with a co-manufacturer, you’re often working through a third party or intermediary. For us, we get to call our main suppliers and they tell us exactly where their inputs are coming from, what’s at risk, what’s not at risk, how deeply we should contract.

And we’re always getting a lot of favorability in those conversations, just because we have those direct relationships. Full visibility into that supply chain, and not being reliant on another party negotiating on your behalf.

Another: How did you evolve your trial and subscription offer as CACs changed after the Apple ATT rollout? Basically when everything got more expensive.

This is around the time that we deleted our lowest acquisition cost offering, our 8-pack. And we pushed people into higher entry points, which allowed us to give that 25%-off discount.

Very counterintuitive, but a huge win for the business in driving more subscription adoption with higher pack sizes.

Of course, CAC went up slightly. But, but overall average order values, lifetime values, and retention rates improved dramatically as well, which was a really favorable change for our payback periods.

Is there a kind of a creative that that works best for Oats Overnight? Is it user-generated? Is it professional actors? Celebrity stuff? What works best?

The answer for this, and for all businesses, is diversity. The algorithms really reward diversity, and the creative itself does the targeting. I know that’s been talked about for a long time now, but it’s true.

We also have a counterintuitive saying: We throw the brand guidelines out for all of our performance media.

You have to have these ads look and feel different, and that drives the most incremental reach across Meta and TikTok’s audiences.

It’s really important to have a bunch of creative diversity and we try to be as diverse as possible. So, all the above, really. We do professional shoots, we do UGC, we do founder ads, we do still photos and flavor shots — a bunch of different stuff. Our ad library is is pretty dense.

Last one from a reader — and maybe this is something you already mostly answered — but what has been the most effective strategy at reducing churn? And how do you combat the problem where some people might just have 50 of these overstocked at home?

Sending options to skip earlier is a good quick lever for combating churn.

I think overall, the biggest impact would just be continuous product improvement. Making your product better, more craveable, more enjoyable has been our biggest lever in reducing churn. But a lot of other small things in the portal.

Thank you so much for your time, Brian. I appreciate it.

Thanks, Dan.

Presented by The WSJ Global Food Forum

Join The Wall Street Journal’s Global Food Forum, June 16–17, 2025, at the Four Seasons Hotel Chicago.

You’ll hear from farmers and food makers about how they’re navigating crisis like new tariffs, bird flu, and inflation.

Chefs, investors, and policymakers will share how they’re pushing boundaries with generative AI and other innovations. And you’ll take away strategies to be a part of the next generation of the food industry.

As a subscriber of The New Consumer, use code NEWCONSUMER20 at checkout to save 20% off your pass.